Chairs

École nationale des ponts et chaussées has been pursuing a strategy of long-term partnerships with companies through industrial chairs. Structured around themes that are strategic for the School, they aim to create scientific and educational value for the School, and competitive innovation for the company.

City and mobility system

- Rail transportation sciences I NAVIER

École nationale des ponts et chaussées | Getlink - What regulations for the city of tomorrow? I LVMT

École nationale des ponts et chaussées | RATP - Mobility Transitions, Mobility Futures I LVMT

École nationale des ponts et chaussées | Île-de-France Mobilités - Lab Recherche Environnement I LVMT-Navier

École nationale des ponts et chaussées | Vinci

Management of risks, resources, and environments

- Fluid mechanics applied to hydraulics and the environment I LHSV

École nationale des ponts et chaussées | EDF R&D - Financial risks I CERMICS

École nationale des ponts et chaussées | Fondation du Risque | Société Générale (fondateur) | École polytechnique | UMPC

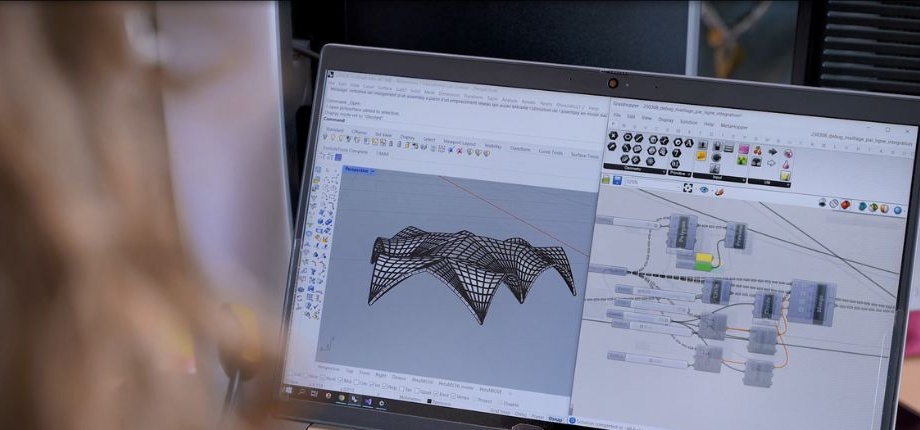

Industry of the future

- Artificial Intelligence for the Aviation industry I CERMICS

École nationale des ponts et chaussées | Air France - Sustainability of energy-related materials and structures I NAVIER

École nationale des ponts et chaussées | Fondation européenne pour les énergies de demain | EDF | Engie | GRT Gaz | MINES ParisTech - Supply Chain of the Future I LVMT I NAVIER

École nationale des ponts et chaussées | Louis Vuitton | Michelin | Renault | Decathlon | Argon and Co

Economics, practices and society

- Forward modeling for sustainable development I CIRED

École nationale des ponts et chaussées | ADEME | EDF | Schneider Electric | GRT Gaz | RTE | TOTALENERGIES - Development and Financing of Sustainable Infrastructure Projects I CIRED

École nationale des ponts et chaussées | MERIDIAM - Futures of quantitative finance I CERMICS

École nationale des ponts et chaussées | BNP Parisbas | Université Paris Cité - Economics of the Urban Ecological Transition (Real Estate, Housing, Architecture, Development) I Economics, management, finance department

École nationale des ponts et chaussées | Fondation du Risque