News & events

Event

19 May. 2026 - 20 May. 2026

For socially engaged social sciences: scientific symposium in honor of Vincent Spenlehauer

The School organizes the scientific symposium itled “For Committed Social Sciences” in tribute to Vincent Spenlehauer, on 19 and 20 May, 2026, on its campus. As Director of the Public Action Training Center for 15 years, he contributed greatly to shaping...

Event

17 Apr. 2026

Engineering program graduation ceremony

The next engineering graduation ceremony will be held on Friday, April 17th, 2026, at La Ferme du Buisson, Noisiel. The program will be announced at a later date.

Event

10 Apr. 2026

Gala des Ponts 2026

The Gala des Ponts, an exceptional evening organised by students from the École Nationale des Ponts et Chaussées, will bring together students, alumni, members of the administration, partner teachers and patrons for a unique event at the Cercle de l'Union...

Event

19 Mar. 2026

Planning and Urban Development Master's program information session

The Planning and Urban Development Master's program organizes an information session, featuring testimonials from students and alumni, for recruitment for the 2026-2027 academic year: 19 March 2026, 12:30 to 01:30 pm Access the online information session

Event

17 Mar. 2026

Salon Executive Education - Le Monde

The Executive Master program and the d.school at the École nationale des ponts et chaussées will be participating in the Executive Education 2026 fair organized by Le Monde. Are you a student with four to five years of higher education and interested in...

Event

02 Mar. 2026 - 04 Mar. 2026

Congress of Young Researchers in Applied Mathematics

École nationale des ponts et chaussées will host the 5th edition of the CJC-MA, Congrès des Jeunes Chercheur.e.s en Mathématiques Appliquées - Congress of Young Researchers in Applied Mathematics. This annual event is targeted at young researchers in...

Event

01 Mar. 2026 - 15 Mar. 2026

The School participates in the 2026 National Engineering Days

The National Engineering Days (JNI) will return in March 2026 for a new edition focused on innovation, sustainability, and impact. Engineers are at the heart of solutions to energy, digital, environmental, and societal challenges. The JNI aims to promote...

News

18 Feb. 2026

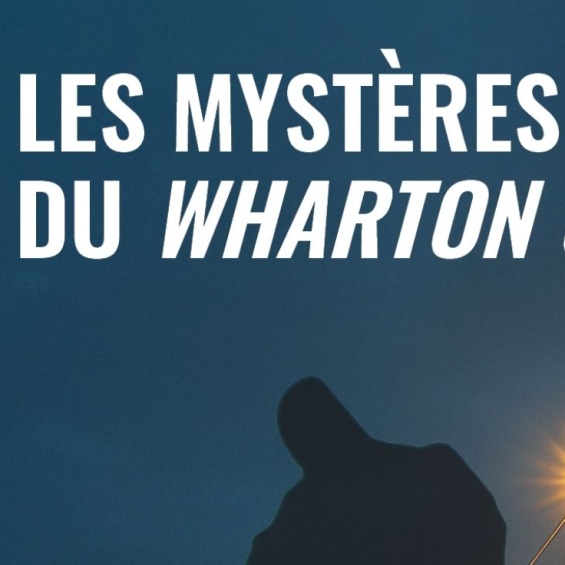

The mysteries of the Wharton of the Sea: a suspense podcast

Put on your headphones and immerse yourself in a world of suspense fiction and scientific research with “The mysteries of the Wharton of the Sea,” our brand-new supense podcast (in French)! By following the adventures of Leila and Noah, two strong-willed...

Event

18 Feb. 2026

Mobility infrastructure: which models, which uses to support territorial development?

As global challenges and transitions accelerate, the pace of action must accelerate too. École nationale des ponts et chaussées, Leonard (VINCI’s foresight and innovation platform) and La Fabrique de la Cité - VINCI’s urban transitions think tank - with...

Event

18 Feb. 2026 - 19 Feb. 2026

Paris Saclay Summit - Choose Science 2026

For the third consecutive year, the Institut Polytechnique de Paris is an academic partner of the Paris Saclay Summit - Choose Science 2026. The Paris-Saclay Summit is a major scientific event bringing together political and economic leaders...

News

17 Feb. 2026

Discover our Master's degree programs

The second round of applications for Master's programs for the 2026-2027 academic year is open until March 26, 2026! Energy transition, mobility, sustainable construction, environmental economics...: benefit from high-level scientific training, leading...

News

17 Feb. 2026

The School wins gold medal for 2nd season of CUBE État competition

École nationale des ponts et chaussées received the gold medal for its second year of participation in the Cube État competition! This award highlights the impressive performance of 22.7% energy savings during the 2024-2025 season for the Carnot-Cassini...