Executive Master in Infrastructure Project Finance

The Mastère Spécialisé® - Executive Master in "Infrastructure Project Finance" is a fast-track and multi-disciplinary program fulfilling a high demand of professionals in the Project Finance Market.

Objectives

The objective of the Infrastructure Project Finance (IPF) program is to provide students with multidisciplinary knowledge on different areas of expertise of engineering, finance, and law applied to complex infrastructure projects finance.

With a curriculum based on real case studies and classes provided by professionals with significant experience in the subject, the master acts as a fast-track program to a successful career in infrastructure finance and investment.

Registrations are open for 2026-2027!

Profiles and qualifications required

Candidates must hold a 4-5-year higher education qualification: Bac+5, or Bac+4 with at least 3 years of professional experience.

Application

Registrations 2026-2027 are open!

If you are interested in joining the program for the next academic year, please prepare your file based on the information provided in these following links:

- Download the instructions for candidates and admission requirements

- Please fill the online form to apply.

The admission sessions are:

Session 1

Admission jury: 19th December 2025

Session 2

Admission jury: 22nd January 2026

Session 3

Deadline for submitting your application: 19th February 2026

Interviews 2026: 24th & 25th February 2026

Admission jury: 26th February 2026

Session 4

Deadline for submitting your application: 21st March 2026

Interviews 2026: 25th & 26th March 2026

Admission jury: 27th March 2026

Don't hesitate to ask for more information about the Executive Master® IPF by sending an email to the Master's Director: clive.gallery@enpc.fr

Admission Committee:

- Director: Clive Gallery

- Professor in Infrastructure Project Finance

Starting date

September 2026

Class number

35 to 45 students per academic year

Admission process

Candidates can apply for the program at any time but our official recruitment process runs from December to June.

All applications will be analysed by an academic and professional jury.

If your current academic qualifications and professional project correspond to our requirements, and you will be invited to an online selection interview.

The admission process (Electronic applications, pre-selection, invitation to interview, final decision) is managed by e-mail.

Please check regularly the spam file of your mailbox to make sure none of our mails have landed there.

Language

The program will be taught entirely in English

Validation

360 hours of in-class lectures – Thesis

• 70% taught by business professionals from the private and public sectors

• 30% taught by professors and researchers

Credits (ECTS European Credit Transfer System):

75 ECTS including 45 ECTS for the modules & 30 ECTS for the professional thesis

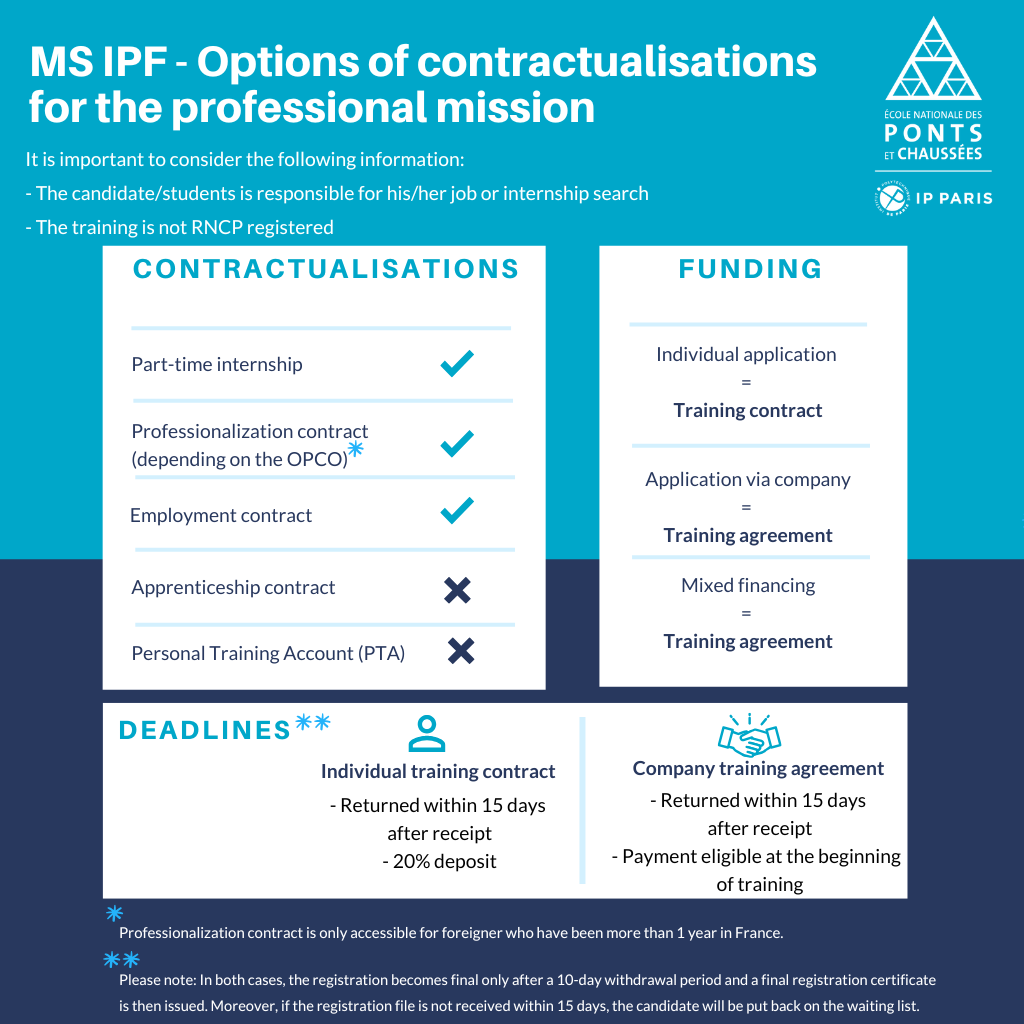

Tuition fees

Tuition fees for the 2026-2027 session :

- €20,000 if financed by Applicant.

- €22,000 if financed by a Non-Partner Company.

These prices are subject to change and exempt from VAT. Enquire for the Partner Company rate.

Housing

Find out more about student housing and our partnership with Studapart.

Funding

The École nationale des ponts et chaussées is listed as a holder of Qualiopi certification for the four activities concerned (training, apprenticeship, VAE and skills assessment). Click on the Funding and Partnership Brochure to learn more.

Program assets

The strengths of the course are:

- The different models allow students to acquire critical thinking and risk analysis abilities

- The program has a diverse student population reflecting multiple cultures and disciplines

- The program is aligned with the current demand from future employers seeking teams that are multicultural and multidisciplinary

- All courses are taught in English

- Global work opportunities for students : Following graduation, around 50% of our graduates will work abroad

- Collaboration with prestigious American universities will be developed in the near future to provide the opportunity for dual degree diplomas. Similar collaborations with other universtities around the world are also being considered.

- All Graduates will have access to the program Active alumni at École nationale des ponts et chaussées.

Skills acquired

Students will develop the abilities required to integrate the different areas of expertise of infrastructure project finance combining engineering, construction, operations, financing, guaranties, insurance and legal practices

Students will learn to negotiate within the constraints of the different stakeholders involved in a project.

Students will acquire the knowledge necessary to develop appropriate term sheets for construction & operations, financing, and contractual & legal aspects of a project.

Career prospects

The skills acquired will enable participants to work in Europe and abroad in :

- Construction industry

- Finance institutions and rating agencies

- Banks

- Insurance companies

- Investment Funds for Infrastructure

- Development Banks or equivalent

- Audit firms

- Law firms

- Administrations

- Public sector institutions

The program is accredited by La Conférence des Grandes Écoles

The program lasts for 12 months and includes 360 hours of lectures, divided into 16 modules, a Professional Assignment of a minimum of 5 months and an Applied Research thesis.

The Program Structure is as follows :

Introduction to Project Finance

- Conferences on Principals and Stakeholders

- Fundamentals of Corporate Finance

- Conferences on Public-Private Partnerships

- Spreadsheet skills for Modeling

Technical skills

- Tax, accounting and legal issues

- Financial Analysis for Infrastructure Projects

- Modeling

- Structured finance

- Hedging instruments and Risk coverage

Management skills

- Negotiating in a multicultural environment

- Corporate and Social Responsibility

- Essentials of Project Management

Application to industrial sectors

- Financing Energy projects

- Financing Infrastructures Projects

- Final Case Study

Professional Assignment and Thesis: 5 months

Schedule

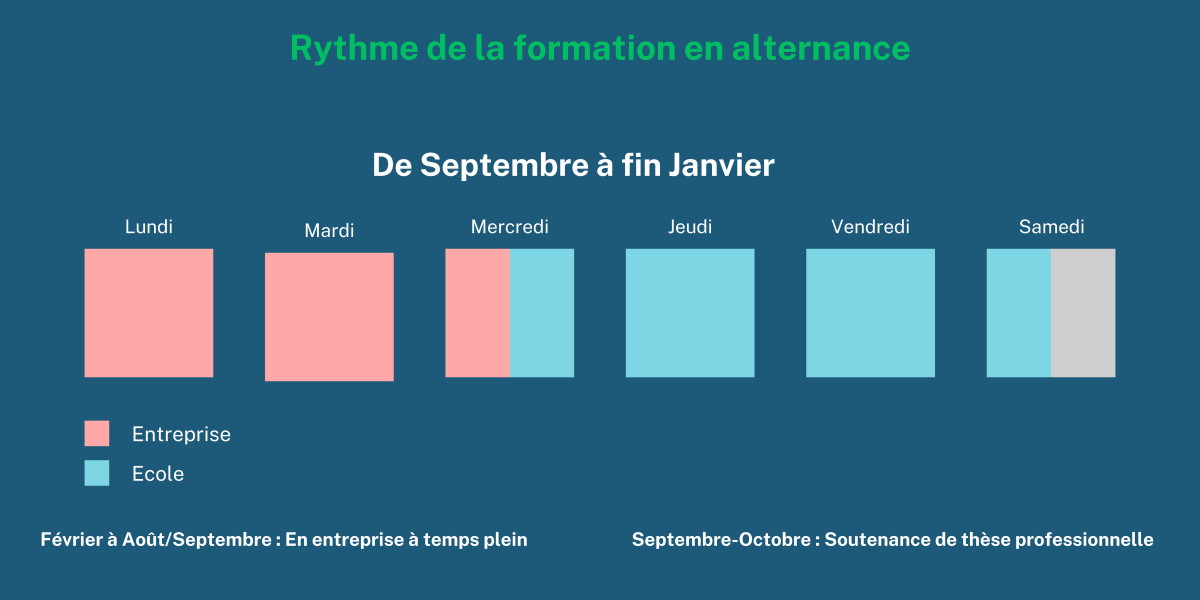

Courses are scheduled Wednesday afternoon, all day Thursday and Friday, and on Saturday morning from the 1st week of September until the last week of January. There will be a break between Christmas and New Year.

The split-week schedule format of the program allows participants to work at an internship or professional activity or to take advantage of work opportunities during the academic semester.

Professional integration and thesis (30 credits)

Students spend a minimum of 5 months in a professional environment (industrial corporation, bank, consulting firm, etc.) to apply the concepts learned and produce a report demonstrating a precise link between concepts and context.

The professional thesis reports will be presented in front of an academic panel.

Students will write an applied research paper utilizing the theoretical background they have received and developing it with an issue relevant to the financial engineering world.

Contact Team MS IPF

Clive GALLERY

Director of the Post-Masters in Infrastrucure Project of Finance

Audrey GABOURG

Inspector of Studies

Ambassadors MS IPF

Nicolas ANDRIEU

Ambassador of the Infrastructure Project Finance Mastère Spécialisé® - Executive Master

Contact or Linkedin

Marieme TALL

Ambassador of the Infrastructure Project Finance Mastère Spécialisé® - Executive Master

Contact or Linkedin

Contact the Executive Master Team by using the following form

Please wait while the form is being downloaded...